Facts about Probate

The first U.S. Probate Court was established in 1784 in Massachusetts as a means of resolving all claims against a deceased person’s estate before then distributing the deceased person’s property to his or her heirs. “power of attorney Archives – Slater and Zurz.” Insert Name of Site in Italics. N.p., n.d. Web. 21 Mar. 2017. Since that time, inheritances that pass through U.S. Probate Courts have grown to $15 trillion.

“…Approximately $15 trillion in inheritances will pass through Probate and Estate Settlement by 2017…”

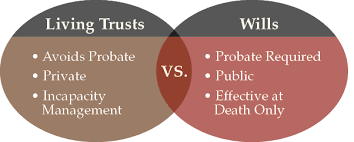

Benefits of a Living Trusts

A living trust will avoid probate, meaning a faster distribution of assets to the heirs. The trustee will be in charge of paying any debts and will distribute the assets according to the instructions of the will.

“…(sometimes called an “inter vivos” or “revocable” trust) is a written legal document through which your assets are placed into a trust for your benefit during your lifetime and then transferred to designated beneficiaries at your death by your chosen representative, called a “successor trustee.”

By forming a living trust, which is a legal document, the estate is settled at an attorney’s office instead of the probate court. Unfortunately, only 5% of real estate properties are held in living trusts, and many of those living trust, are not managed properly. As a result, the property settlement comes under the jurisdiction of the probate court. That means that 95% of the population will have to settle their estate by going through the probate court.

Sometimes this happens when the real property is refinanced, and later, the owner forgets to file the necessary paperwork to place the property back into the trust.

Here is an examples of well-known names whose assets had to go through the probate process. Some did have a trust but it had not been updated or it was not properly prepared:

Famous Banker J.P. Morgan

Whitney Houston

Steve Jobs

Walt Disney

Phillip Seymour Hoffman

Sonny Bono

As you can see from the list above, these were wealthy individuals who were expected to have been advised, legally and financially but somehow failed to. Therefore, they all had assets that had to go through probate before the estate could be settled.

By forming a living trust, which is a legal document, the estate is settled at an attorney’s office instead of the probate court.

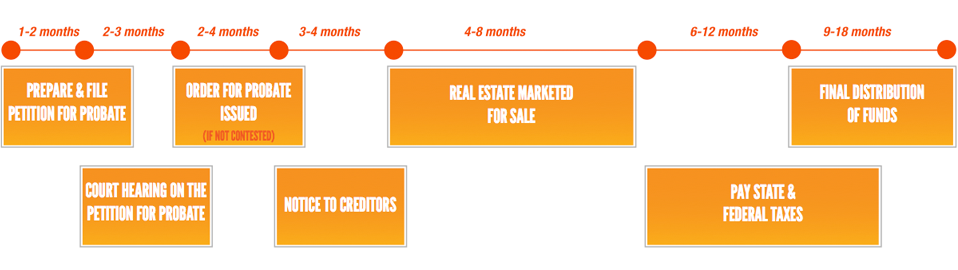

Click here for a more comprehensive timeline for the process of a Probate.

Probate estate settlements are filed in the probate court upon an individual’s death_ whether the deceased leave a will or not. That is why 90-95 90 % of the cases have to go through the probate process.

Documents and procedures to for a petition

There are two ways a Petition for Probate can be filed: directly to the court by the person petitioning to be the personal representative of the estate, or through an attorney filing on behalf of the estate. Once a Petition for Probate is filed, the probate process begins.

This public record will include information such as:

- Name of petitioner

- Contact information

- Property value

- Depending on the county, the property address

- Any encumbrances on the property

- A list of all beneficiaries

After having filed, the court will respond within 30-40 days, At this time, the court will appoint a person to handle the administration of the estate; known as the personal representative (PR). Who typically is an heir in the Will, this person is designated a title and legal powers. Depending on the presence of a Will, the PR will receive the title “Executor,” meaning a Will is on record or “Administrator,” meaning no Will is on record. Doesn’t matter; both have the same legal responsibilities.

Once the Orders document authorizes a person to be in charge of any action related to the estate. And only at this point, that person can initiate the sale of any property withing the estate; However, no transaction can be completed until a Letter of Administration / Testamentary has been received.

Responsibilities of the person in charge of the estate

Most administrators and executors feel overwhelmed, frustrated and lost when suddenly having to deal with all these extra responsibilities; in addition to managing their already busy family life and a job, when they just want to move on.

The added financial responsibilities and emotional stress of Probate

- Mortgage

- Insurance

- Association fees

- Medical, hospital and funeral bills

- Property taxes

- Probate taxes

- State and federal taxes

- Attorney fees, estate settlement fees

Guardianship ( Minor and Adult)

Adult guardianships, called conservatorships in some states, To protect adults who no longer have the capacity to care for themselves or their assets. (Alzheimer’s, dementia, Parkinson’s disease or some other debilitating chronic condition). These individuals are probably receiving 24-hour in-home care or are living in a nursing home. The costs for such care can be very expensive, easily totaling $5—$6K per month or more. The heirs need to assure that these bills are paid if they want their family member to receive continued care.

Liquidating The Estate

When the court appoints the personal representative (PR), it grants that individual either full or limited powers. This can also be called independent administration (full authority) and dependent administration (limited authority). A PR, with full authority, can make decisions such as selling estate real estate without prior court approval. In this case, the PR goes through typical real estate sales procedures. This type of probate sale is like a traditional sale.

In many states, a real estate sale involving a PR with limited authority goes through a process called court confirmation. Court confirmations vary from state-to-state; some use a formal hearing process, while others simply require the presiding judge’s signature.

In probate real estate sales, everything starts with the court. Settling estates requires various court documents and legal decisions leading up to real estate liquidations.

When liquidating the estate property, the PR has two options:

To sell the real property directly to a buyer; or to sell by listing it with a real estate agent.

More than 85% of probate properties. PRs rarely sell property directly because of the added responsibilities, hassles, emotional stress and, most importantly, legal liabilities. Once misstep or miscalculation and they may find themselves in trouble with the court and perhaps, getting sued by one or more of the heirs. That is why the majority prefer to work directly with a real estate agent, who is licensed, bonded and an expert in the field of estate settlement.

Letters of Administration. Thirty-to-forty days after Orders are issued, the person in charge of the estate receives Letters of Administration, also known as Letters Testamentary. This document allows the personal representative to transfer the title of the deceased assets. The PR can transfer title of the estate’s real property upon confirmation.

Let me help. I can take some of the pain and uncertainty that occurs during a Probate process.

Credits:

-

power of attorney Archives – Slater and Zurz. (n.d.). Retrieved from https://slaterzurz.com/tag/power-of-attorney/

-

Top Three Benefits of a Living Trust | LegalZoom. (n.d.). Retrieved from https://www.legalzoom.com/articles/top-three-benefits-of-a-living-trust

-

Google picture https://goo.gl/images/ZhKslv